Stock Tracker vs. Manual Tracking: A Comparison

Stock Tracker vs. Manual Tracking: Which is Better?

In the ever-evolving world of investing, one of the critical decisions investors face is how to effectively manage their portfolios. Whether you are a seasoned investor or just starting out, the tools you use to track your investments can have a significant impact on your success. Traditionally, many investors relied on manual methods, such as spreadsheets, to track their stocks. However, with the advent of sophisticated stock tracking software, the landscape has changed dramatically. This article explores the pros and cons of using a dedicated stock tracker compared to manual tracking and highlights why embracing technology might be the smarter choice for today’s investors.

The Case for Manual Tracking

Manual tracking, often done through spreadsheets like Microsoft Excel or Google Sheets, has been a long-standing method for managing investments. It offers several advantages, particularly for those who prefer a hands-on approach to their finances.

1. Customization

One of the primary benefits of manual tracking is the high degree of customization it offers. Investors can create their own templates, set up personalized formulas, and design the layout of their spreadsheets to fit their specific needs. This level of flexibility allows investors to tailor their tracking systems to reflect their investment strategies, risk tolerance, and financial goals.

2. Control Over Data

Manual tracking gives investors complete control over their data. Since all information is entered and managed by the user, there is no reliance on third-party software or platforms. For those who are particularly cautious about data privacy and security, this control can be a significant advantage. Investors can also back up their data in a way that suits them, ensuring they have access to their financial information at all times.

3. Cost-Effectiveness

Spreadsheets are often free or come as part of software packages that many people already own. This makes manual tracking a cost-effective option, especially for those who are just starting out and may not want to invest in specialized software right away. Additionally, there are no subscription fees or hidden costs associated with manual tracking, which can be appealing to budget-conscious investors.

4. Familiarity

Many people are already familiar with spreadsheet software, having used it for various tasks in both their personal and professional lives. This familiarity can make the learning curve for manual tracking relatively shallow, allowing investors to start tracking their portfolios without needing to learn new software or tools.

The Downsides of Manual Tracking

While manual tracking offers several advantages, it is not without its drawbacks. As investment portfolios grow and markets become more complex, the limitations of manual tracking become more apparent.

1. Time-Consuming

One of the biggest disadvantages of manual tracking is the time it requires. Investors must input all data manually, which can be a tedious and time-consuming process, especially for those managing multiple portfolios or frequently trading stocks. This method also requires regular updates, as stock prices, dividends, and other relevant information change constantly. Over time, the amount of effort required to maintain an accurate and up-to-date spreadsheet can become overwhelming.

2. Prone to Human Error

Human error is an unavoidable risk when relying on manual tracking. A simple mistake in data entry, a missed update, or a miscalculated formula can lead to incorrect information, which can, in turn, result in poor investment decisions. The lack of automated checks and balances means that errors can go unnoticed, potentially affecting the accuracy of the entire portfolio.

3. Limited Analytical Tools

While spreadsheets offer some analytical capabilities, they are limited compared to what dedicated stock tracking software can provide. Creating detailed reports, conducting in-depth analyses, and visualizing data can be challenging and time-consuming when done manually. Investors looking to gain deeper insights into their portfolios may find manual tracking insufficient for their needs.

The Case for Stock Trackers

Dedicated stock tracking software, like Pro Stock Tracker, has become increasingly popular among investors due to its ability to streamline the investment management process. These tools offer a range of features that can enhance the efficiency and accuracy of portfolio tracking.

1. Automated Data Entry and Updates

One of the most significant advantages of using a stock tracker is the automation of data entry and updates. Unlike manual tracking, where investors must input every detail themselves, a stock tracker can automatically pull in data such as stock prices, dividend payments, and corporate actions. This not only saves time but also reduces the risk of human error, ensuring that the information is always accurate and up-to-date.

2. Comprehensive Portfolio Management

Stock trackers are designed to handle the complexities of portfolio management, offering tools that go beyond basic tracking. For example, Pro Stock Tracker provides users with performance reports, diversification analysis, and benchmarking against market indices. These features help investors gain a clearer understanding of their portfolio’s performance and make informed decisions based on comprehensive data.

3. Centralized and Organized Data

Stock tracking software centralizes all investment data in one place, making it easier to manage and review. Users can access their portfolios from any device, ensuring they have up-to-date information at their fingertips whenever they need it. This organization and accessibility are particularly valuable for investors who manage multiple portfolios or accounts.

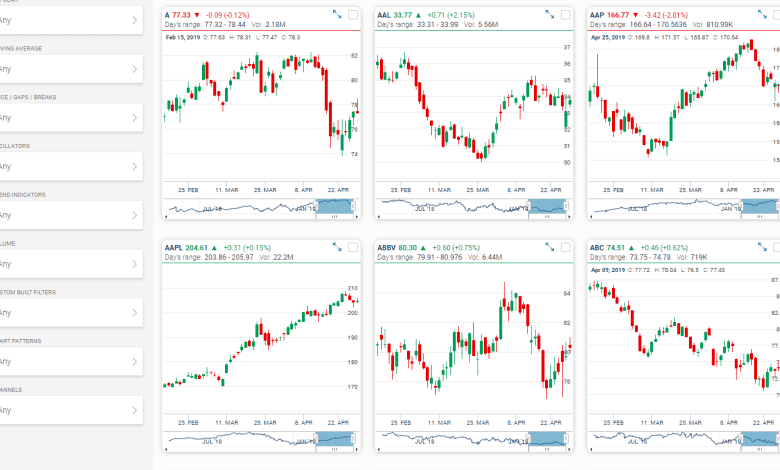

4. Advanced Analytics and Reporting

One of the standout features of stock trackers is the advanced analytics and reporting capabilities they offer. These tools allow investors to generate detailed reports on portfolio performance, assess risk levels, and compare investments over distinct and cumulative periods. Such insights are difficult, if not impossible, to achieve through manual tracking alone, making stock trackers a valuable tool for those looking to optimize their investment strategies.

5. User-Friendly Interface

Modern stock trackers are designed with user experience in mind, offering intuitive interfaces that make portfolio management more accessible to all investors. Whether you are new to investing or have years of experience, stock trackers can simplify the process, allowing you to focus on making strategic decisions rather than on the mechanics of tracking.

Conclusion

While manual tracking may offer customization, control, and cost-effectiveness, it is often outweighed by the time commitment and potential for human error. On the other hand, dedicated stock tracking software like Pro Stock Tracker offers automation, comprehensive portfolio management, and advanced analytics, making it a more efficient and reliable option for most investors.

Ultimately, the choice between manual tracking and using a stock tracker depends on your specific needs, the complexity of your portfolio, and how much time you are willing to invest in managing your investments. As technology continues to evolve, the advantages of using a dedicated stock tracker are likely to grow, making it an increasingly attractive option for investors looking to streamline their investment process and achieve their financial goals.