Unlocking Wealth: Exploring High-Return Investment Plans

Introduction

Investing is a crucial part of financial planning, and finding the best investment plan with high returns is a goal shared by many. Whether you’re looking to build wealth, save for retirement, or achieve specific financial goals, the right investment strategy can help you grow your money over time. In this article, we will explore various investment options and strategies to help you make informed decisions and maximize your returns.

Understanding Risk and Return

Before diving into specific investment plans, it’s essential to understand the relationship between risk and return. Generally, investments with higher potential returns also come with higher levels of risk. The key to successful investing is finding a balance that aligns with your financial goals and risk tolerance.

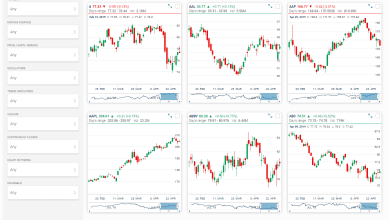

- Stock Market Investments

Investing in the stock market is one of the most common ways to potentially achieve high returns. Stocks represent ownership in companies, and their value can fluctuate daily based on various factors, including company performance, economic conditions, and market sentiment.

Here are some stock market investment strategies to consider:

- Individual Stocks: Purchasing shares of individual companies allows you to potentially benefit from their success. However, this approach comes with higher risk as the fortunes of individual companies can be volatile.

- Exchange-Traded Funds (ETFs): ETFs offer diversification by pooling funds from multiple investors to invest in a basket of stocks or other assets. They can provide exposure to various sectors and industries while spreading risk.

- Mutual Funds: Mutual funds are managed investment pools that invest in a diversified portfolio of stocks. They are a suitable option for investors seeking professional management and diversification.

- Bonds

Bonds are debt securities issued by governments, corporations, or municipalities. When you invest in bonds, you are essentially lending money to the issuer in exchange for periodic interest payments and the return of the bond’s face value at maturity. Bonds are generally considered lower risk than stocks fatih escort but offer lower potential returns.

Here are some types of bonds to consider:

- Government Bonds: These are issued by governments and are often considered the safest bond investments. Examples include U.S. Treasury Bonds and Municipal Bonds.

- Corporate Bonds: These are issued by corporations and offer higher yields than government bonds but come with higher credit risk.

- Municipal Bonds: Issued by municipalities, these bonds offer tax advantages for certain investors and can be a source of stable income.

- Real Estate Investments

Investing in real estate can provide both rental income and the potential for property appreciation. Real estate investment options include:

- Rental Properties: Owning rental properties can generate consistent rental income, and property values may appreciate over time. However, managing rental properties requires time and effort.

- Real Estate Investment Trusts (REITs): REITs are companies that own and manage income-producing real estate, such as apartment complexes, commercial properties, and shopping malls. Investing in REITs provides diversification and liquidity.

- Alternative Investments

In addition to traditional investments, there are alternative investment options that can potentially offer high returns. These include:

- Private Equity: Investing in private companies or venture capital funds can yield substantial returns if the businesses succeed. However, these investments often have a longer investment horizon and higher risk.

- Hedge Funds: Hedge funds employ various strategies to generate returns and may invest in stocks, bonds, derivatives, or other assets. They are typically open to accredited investors and require a significant initial investment.

- Cryptocurrencies: Digital currencies like Bitcoin and Ethereum have gained popularity as speculative investments. While they have the potential for high returns, they are also highly volatile and speculative.

- Retirement Accounts

Investing in retirement accounts, such as 401(k)s and IRAs, can provide tax advantages and help you save for retirement. These accounts offer a range of investment options, including stocks, bonds, and mutual funds. The key advantage is that your investments can grow tax-deferred or tax-free, depending on the account type.

- Diversification and Risk Management

Diversification is a fundamental strategy for managing risk while seeking high returns. By spreading your investments across different asset classes, you reduce the impact of a poor-performing investment on your overall portfolio. Diversification can be achieved through a mix of stocks, bonds, real estate, and alternative investments.

- Dollar-Cost Averaging

Dollar-cost averaging is an investment strategy where you regularly invest a fixed amount of money, regardless of market conditions. This approach can help reduce the impact of market volatility and allow you to buy more shares when prices are low and fewer shares when prices are high.

- Long-Term Perspective

High-return investments often require a long-term perspective. The stock market, for example, has historically provided strong returns over extended periods, but short-term fluctuations are common. It’s crucial to stay focused on your long-term goals and avoid making emotional investment decisions based on short-term market movements.

- Risk Tolerance and Financial Goals

Your risk tolerance and financial goals should drive your investment decisions. If you have a high risk tolerance and a long investment horizon, you may be comfortable with a more aggressive portfolio. However, if you’re nearing retirement or have a lower risk tolerance, a more conservative approach may be appropriate.

Considerations for high investment plan

The factors which can look before investing in these best investment plan with high returns.

- Risk Assessment: Conduct a thorough risk assessment to determine your risk tolerance accurately. Factors such as age, financial obligations, and overall financial stability play a role in your risk tolerance. It’s essential to be honest with yourself about how much risk you can comfortably take on.

2. Costs and Fees: Be aware of the costs associated with different investment options. Mutual funds and ETFs, for example, often charge management fees. Additionally, trading commissions may apply to buying and selling stocks or other securities. High fees can eat into your returns, so choose investments with costs that align with your investment goals.

3. Time in the Market, Not Timing the Market: Trying to time the market by predicting when to buy and sell investments is notoriously difficult. Instead, focus on time in the market. Consistently investing over time, especially through market ups and downs, is a more reliable strategy for long-term success.

4. Tax Efficiency: Consider the tax implications of your investments. Different types of accounts (e.g., Traditional IRAs, Roth IRAs, and taxable brokerage accounts) offer various tax advantages. For example, Roth IRAs allow tax-free withdrawals in retirement, while Traditional IRAs offer tax deductions on contributions. Tax-efficient investing can significantly impact your after-tax returns.

5. Asset Allocation: Your asset allocation, or the mix of different asset classes in your portfolio, is a critical factor in achieving your investment goals. Based on your risk tolerance and time horizon, decide how much of your portfolio should be allocated to stocks, bonds, real estate, and other assets. Rebalance your portfolio periodically to maintain your desired allocation.

6. Regular Review: Periodically review your investment portfolio to ensure it aligns with your financial goals and risk tolerance. As your circumstances change, you may need to adjust your investments accordingly. Rebalancing and reviewing your portfolio can help you stay on track.

Conclusion

Finding the best investment plan with high returns requires careful consideration of your financial goals, risk tolerance, and investment horizon. While there are various investment options available, including stocks, bonds, real estate, and alternative investments, it’s essential to create a diversified portfolio that aligns with your unique circumstances.

Remember that high returns often come with higher risk, so it’s crucial to strike a balance that allows you to achieve your financial objectives while managing risk effectively. Consult with a financial advisor if you’re unsure about the best investment strategy for your specific situation, and always stay informed about the investments you choose. In the world of investing, knowledge is a valuable asset that can help you make informed decisions and maximize your returns over time.